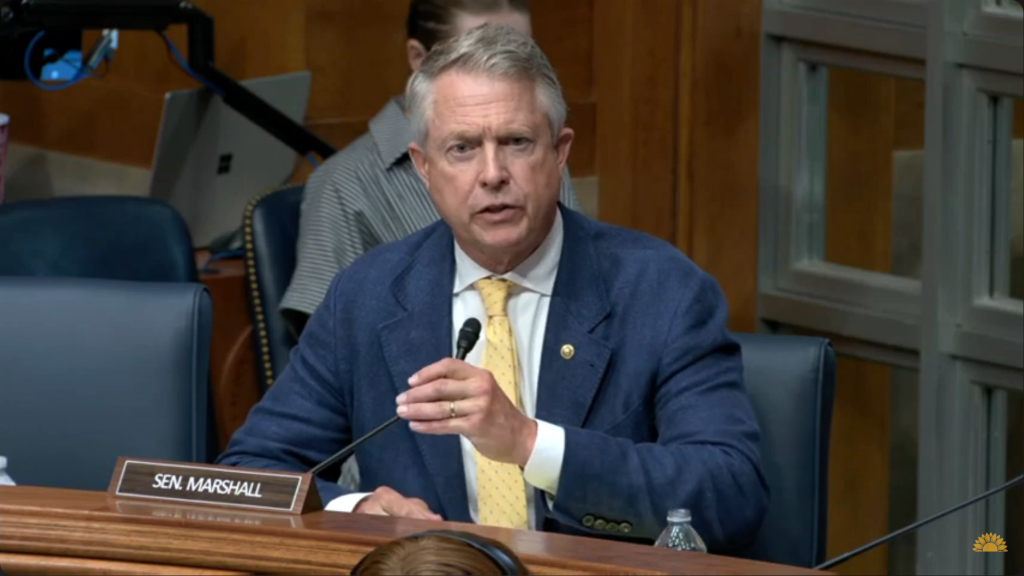

Senator Marshall: Association Health Plans are a Great Resource for Kansans

Senator Marshall Questions Experts About Benefits Access for Independent Workers

Washington – On Thursday, U.S. Senator Roger Marshall, M.D. (R-Kansas),questioned Patrice Onwuka, Director at the Center for Economic Opportunity at the Independent Women’s Forum, Kev Coleman, Research Fellow at the Paragon Health Institute, and Karen Friedman, Executive Director at the Pension Rights Center, during a recent Health, Education, Labor, and Pensions (HELP) committee focused on benefits for independent workers.

Click HERE or on the image above to watch Senator Marshall’s full interview.

Highlights from the hearing include:

On what protections would exist if a portable benefits provider went under:

Senator Marshall: “Let’s start with Mrs. Onwuka. Welcome everybody. We appreciate you being here. Under a portable benefit model, what protections do workers have if a benefit provider were to go under or misuse funds?”

Mrs. Onwuka: “Under a portable benefits plan, I think that there are protections in place to ensure that, you know, whatever investments have been made, whatever has been paid into it, that that would still be there and protected. There’s some great companies that have those accounts and set those up to ensure that, and they’re regulated to ensure that that happens.”

Senator Marshall: “Have many of them failed? Or has that happened very often?”

Mrs. Onwuka: “I have not seen anything any of them fail, sir.”

On what’s preventing wider adoption of association health care plans:

Senator Marshall: “Mr. Coleman, let’s go to you next. I’m a big fan of association health care plans. It’s something I fought for to help become a possibility. I’ve seen some acceptance of it, I’m surprised it’s not more, so to be honest. What’s keeping that from exploding in a good way, and what do we need to do to put wind beneath those sails?”

Mr. Coleman: “Senator, thank you very much for that question. A primary obstacle to association health plans, underneath legacy regulation, deals with the obstacles to be able to form a coalition of our association of businesses whose aggregate employee body can be seen as a single health plan. There’s something known as ‘lookthrough doctrine,’ which says, if you don’t have the right affiliations among businesses, we’re going to treat each individual business within an association as its own entity with respect to health insurance. And hence, if they have three people, they’re in the small group health insurance.”

Senator Marshall: “Got it – so, is this that we need to change the law, or is it a regulatory issue?”

Mr. Coleman: “Ultimately, changing the law is best, because not only do you have the benefit of, you know, a very clear statutory precedent, but you also have a situation where technologists like myself, or my former self, are going to make investments in that market to build platforms facilitating technology, et cetera. If it’s a regulatory solution, there’s more hesitation, because there’s the fear that the next administration may change regulation.”

Senator Marshall: “Okay, thanks. And I would just ask the committee staff, I’m sure you’re looking at that, but would love to kind of understand what we can do to improve that situation as well. We’ve seen some great success in Kansas with some of these plans, and again, I’m surprised there’s not more people utilizing it.”

On how portable benefits could be on par with benefits offered to W2 employees:

Senator Marshall: “I’ll go to Ms. Friedman next. And if you just briefly explain…how under portable benefits can we be sure that employers are still providing benefits on par with many of the W2 employees?”

Ms. Friedman “…I mean, look, portability has been an intractable problem in the retirement space. There are lots of proposals that will address this. Senator Sanders, pensions for all would be portable. The state-facilitated auto-Iris has some portability. I think we have to ensure that we’re looking at solutions. I mean, what we’re trying to do is address a concern, which is portability. People changing jobs a lot, and benefits going with them. We need to be exploring those options and make sure that they’re options that both protect employees and also are being workable.”

Senator Marshall: “So I understand the problem, now I’m looking for the solution. Mrs. Onwuka, can you take a shot at that? How, under portable benefits, can we be sure that employers are still providing benefits on par with W2 employees?”

Mrs. Onwuka: “Well, that can be negotiated between the independent contractor and their client, really, who’s able to pay in you know, just as they in their contracts, they can define how much the employer is willing to pay this independent contractor on top of their negotiated rate, how much they’re going to pay into that benefits plan. And they can match with whatever they’re paying their W2 employees in terms of the benefits that they’re providing there. But let’s not forget, these plans can be paid into by multiple different clients and different entities, so an independent contractor can really do well in terms of being negotiating the kind of, you know, benefits package that works for them.”

Senator Marshall: “Typically, if you were new to that negotiation and you have seven or ten clients or people you’re working for, are you asking them to match like 10% or 20%? Is there a kind of a range that you’re looking for?”

Mrs. Onwuka: “It would be up to that independent contractor to decide, sir.”

###

Contact: Payton Fuller