- September 14, 2022

1,700 Companies, 200 Trade Associations Announce Support for Sen. Marshall’s Credit Card Competition Act

(Washington, D.C., September 14, 2022) – U.S. Senator Roger Marshall, M.D. today announced that nearly 1,700 companies across retails sectors and more than 200 trade associations voiced support for his bill, the Credit Card Competition Act. Senators Marshall and Dick Durbin (D-IL) introduced this bipartisan legislation to slash credit card swipe fees and enhance competition and choice in the credit card market.

“Swipe Fees are an inflation multiplier, and I am proud to have the support of nearly 1,700 companies and 200 trade associations on our Credit Card Competition Act,” said Senator Marshall. “When it comes to Main Street vs Wall Street, I’ll choose Main Street every time. Convenience stores, gas stations and other small businesses in Kansas are being taken advantage of by Visa and MasterCard on behalf of big banks in New York City at a time when they, and the communities they serve, are grappling with crippling inflation and are dealing with an ongoing recession. It’s gone on long enough. Competition is the heartbeat of capitalism and that is what our bill will create, competition.”

Senator Marshall recently appeared on Fox Business’ Making Money with Charles Payne to discuss his legislation. You may click HERE or on the image below to watch Senator Marshall’s interview.

Background:

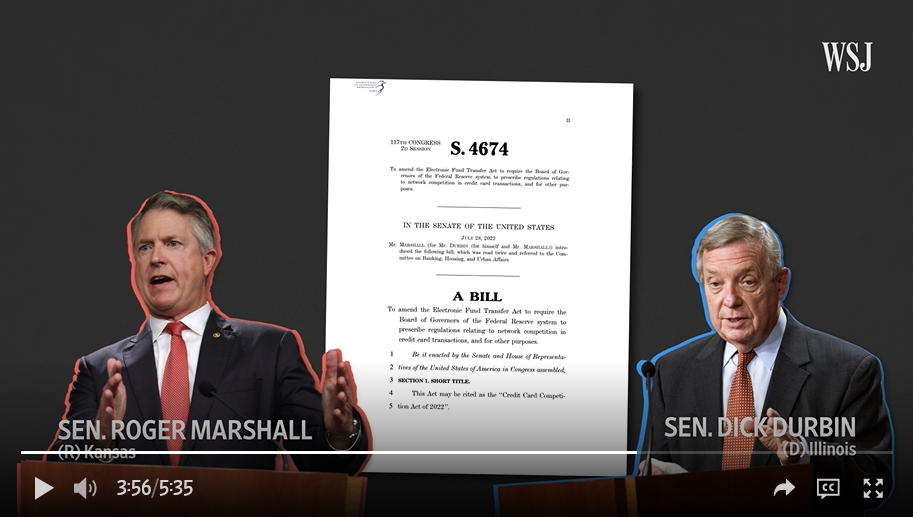

The Wall Street Journal highlighted Senator Marshall’s legislation in a video report called Why Using Your Credit Card Is Getting More Expensive, which explains that the costs for processing credit card transactions have increased and how businesses are passing those higher costs onto consumers or declining to accept credit card payments. You may click HERE or on the image below to watch the full report.

Recently, Senator Marshall visited a QuikTrip in downtown Wichita to work behind the counter and see the issue of rising swipe fees first hand. The QuikTrip Senator Marshall visited is one of 1,213 convenience stores across Kansas, which pay more than $110 million in credit card fees annually – their second highest operating cost behind labor. You may click HERE or on the image below to watch coverage of Senator Marshall’s QuikTrip swipe fee event.

Additionally, Senator Marshall recently penned two op-eds on the Credit Card Competition Act of 2022. You may click HERE to read his piece in the Kansas City Star/Wichita Eagle or HERE to read his piece in the Washington Examiner.

There are currently four U.S. credit card networks: Visa, Mastercard, American Express, and Discover. Visa and Mastercard are known as “four-party” networks; they act as agents for thousands of card-issuing banks and mandate the fees and terms that the banks receive from merchants for each transaction. Merchants have effectively no leverage to negotiate fee rates and terms in four-party network systems, because they cannot risk losing access to all the consumers served by Visa’s and Mastercard’s member banks.

Visa and Mastercard wield enormous market power in credit cards; according to the Federal Reserve, they account for nearly 576 million cards, or about 83 percent of general-purpose credit cards. Approximately $3.49 trillion was transacted on Visa and Mastercard credit cards in the U.S. in 2021. Visa’s and Mastercard’s market power and network structure have enabled them to impose fees on U.S. merchants that are among the world’s highest, charging a total of $77.48 billion in U.S. merchant credit card fees in 2021. These fees include interchange or swipe fees which Visa and Mastercard require merchants to pay to issuing banks, as well as network fees that Visa and Mastercard require merchants to pay directly to them. Consumers ultimately pay for all of these fees in the price of the goods and services they buy.

Under the Credit Card Competition Act, the Federal Reserve would issue regulations, within one year, ensuring that banks in four-party card systems that have assets of over $100 billion cannot restrict the number of networks on which an electronic credit transaction may be processed to less than two unaffiliated networks, at least one of which must be outside of the top two largest networks. This would inject real competition into the credit card market—opening the door for new market entrants such as current debit-only networks, encouraging innovation and enhanced security, creating backup options if a network crashes, and exerting competitive constraints on Visa and Mastercard’s fee rates.

In April, Durbin, Marshall, and U.S. Representatives Peter Welch (D-VT) and Beth Van Duyne (R-TX) sent a bipartisan, bicameral letter to the CEOs of Visa and Mastercard urging the companies not to proceed with plans to raise their interchange fee rates. Visa and Mastercard nonetheless proceeded to raise fee rates, prompting Durbin to hold a Senate Judiciary Committee hearing in May on excessive swipe fees and barriers to competition in the credit card system.

###