- August 18, 2022

ICYMI: Why Using Your Credit Card Is Getting More Expensive

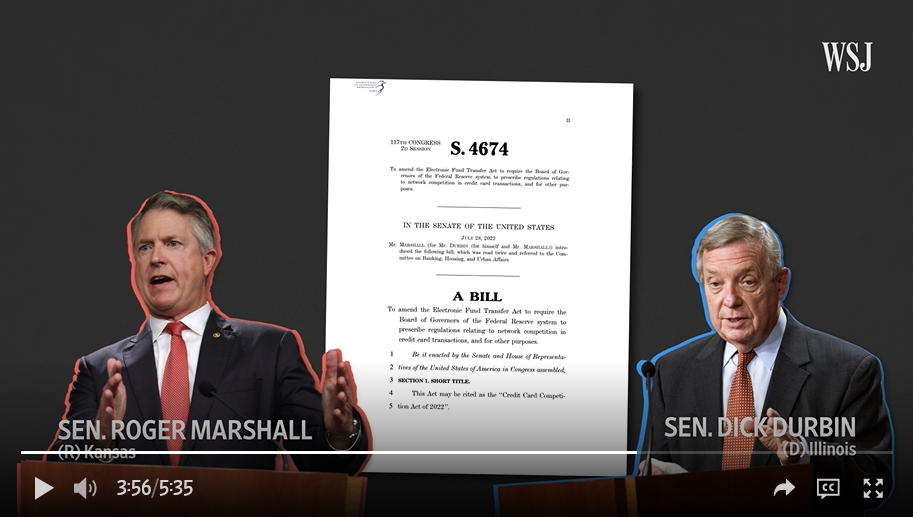

(Washington, D.C., August 18, 2022) – Today, the Wall Street Journal highlighted U.S. Senators Roger Marshall, M.D. (R-KS) and Dick Durbin’s (D-IL) bipartisan legislation, the Credit Card Competition Act of 2022. The bill enhances competition and choice in the credit card network market, which is currently dominated by the Visa-Mastercard duopoly. Building off of debit card competition reforms enacted by Congress in 2010, the bill would direct the Federal Reserve to ensure that giant credit card-issuing banks offer a choice of at least two networks over which an electronic credit transaction may be processed, with certain exceptions. You may click HERE or on the image below to watch the WSJ explain the issue of credit card swipe fees and what Senators Marshall and Durbin are doing about it.

WSJ: Why Using Your Credit Card Is Getting More Expensive

As fees to use credit cards rise, Congress is looking to inject competition into the industry.

The cost to process a credit card transaction has gone up and many businesses are passing that on to the consumer. WSJ explains the hidden fees behind using your card, and what Congress is trying to do about them.

Senator Marshall recently penned two op-eds on the Credit Card Competition Act of 2022. You may click HERE to read his piece in the Kansas City Star/Wichita Eagle or HERE to read his piece in the Washington Examiner.

Background:

There are currently four U.S. credit card networks: Visa, Mastercard, American Express, and Discover. Visa and Mastercard are known as “four-party” networks; they act as agents for thousands of card-issuing banks and mandate the fees and terms that the banks receive from merchants for each transaction. Merchants have effectively no leverage to negotiate fee rates and terms in four-party network systems, because they cannot risk losing access to all the consumers served by Visa’s and Mastercard’s member banks.

Visa and Mastercard wield enormous market power in credit cards; according to the Federal Reserve, they account for nearly 576 million cards, or about 83 percent of general-purpose credit cards. Approximately $3.49 trillion was transacted on Visa and Mastercard credit cards in the U.S. in 2021. Visa’s and Mastercard’s market power and network structure have enabled them to impose fees on U.S. merchants that are among the world’s highest, charging a total of $77.48 billion in U.S. merchant credit card fees in 2021. These fees include interchange or swipe fees which Visa and Mastercard require merchants to pay to issuing banks, as well as network fees that Visa and Mastercard require merchants to pay directly to them. Consumers ultimately pay for all of these fees in the price of the goods and services they buy.

Under the Credit Card Competition Act, the Federal Reserve would issue regulations, within one year, ensuring that banks in four-party card systems that have assets of over $100 billion cannot restrict the number of networks on which an electronic credit transaction may be processed to less than two unaffiliated networks, at least one of which must be outside of the top two largest networks. This would inject real competition into the credit card market—opening the door for new market entrants such as current debit-only networks, encouraging innovation and enhanced security, creating backup options if a network crashes, and exerting competitive constraints on Visa and Mastercard’s fee rates.

In April, Durbin, Marshall, and U.S. Representatives Peter Welch (D-VT) and Beth Van Duyne (R-TX) sent a bipartisan, bicameral letter to the CEOs of Visa and Mastercard urging the companies not to proceed with plans to raise their interchange fee rates. Visa and Mastercard nonetheless proceeded to raise fee rates, prompting Durbin to hold a Senate Judiciary Committee hearing in May on excessive swipe fees and barriers to competition in the credit card system.

###